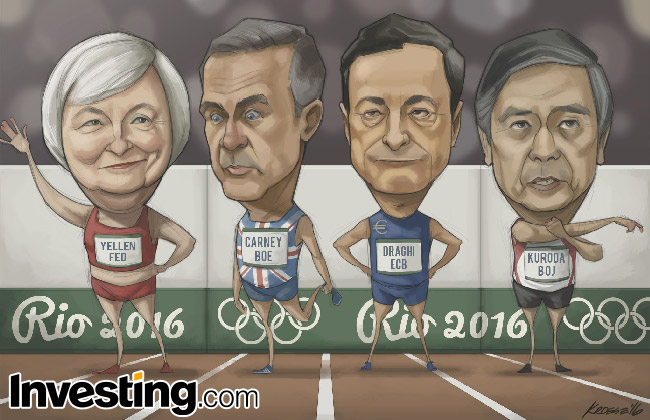

Investing.com - This week’s comic combines the 2016 Olympic Games in Rio and the flurry of recent central bank activity in developed economies.

The Bank of England, led by Governor Mark Carney, cut interest rates to a record-low 0.25% earlier in August and launched fresh easing measures in a bid to buffer the economy from a downturn following the Brexit vote.

Meanwhile, slow growth and virtually non-existent euro zone inflation will also force European Central Bank President Mario Draghi to extend and expand the scope of its asset purchase program as soon as next month, according to market experts.

Elsewhere, the Bank of Japan, led by Governor Haruhiko Kuroda, approved only moderate stimulus measures at the conclusion of its monetary policy meeting late last month, disappointing markets which were hoping for much more aggressive easing.

While the BoJ eased its monetary policy further by increasing its purchases of exchange-traded funds, it opted not to cut interest rates deeper into negative territory or increase the monetary base, as analysts had widely expected.

The BoJ said it will conduct a thorough assessment of the effects of negative interest rates and its massive asset-buying program in September, suggesting that a major overhaul of its stimulus program may be forthcoming.

In contrast, market players continued to evaluate the likelihood that the Federal Reserve will raise interest rates by the end of this year.

Fed funds futures prices showed traders now see a 40% chance of a U.S. rate hike by December, according to CME Group's (NASDAQ:CME) Fed Watch tool. September odds were at around 9%.

A speech by Fed Chair Janet Yellen at the central bank's August 26 symposium in Jackson Hole, Wyoming, will be closely watched for any new indications of when an interest rate increase is likely.

Based on their performances so far, and in the spirit of the Summer Olympics, tell us in the comments section below which central banker deserves a gold medal and who deserves to be left off the podium.

To see more of Investing.com’s weekly comics, visit: http://www.investing.com/analysis/comics